With the country spiraling deeper into recession, the Federal Reserve is ready to slash its key interest rate -- perhaps to an all-time low-- in hopes of cushioning some of the economic fallout felt by many struggling Americans.

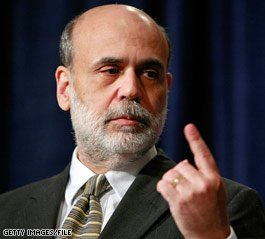

To battle the worst financial crisis since the 1930s, Fed Chairman Ben Bernanke and his colleagues already have ratcheted down their main lever for influencing the economy -- the federal funds rate -- to 1 percent, a level seen only once before in the last half-century.

The Fed opens a two-day meeting Monday to assess to economy and decide its next move on rates. Another reduction to the funds rate, the interest banks charge each other on overnight loans, is all but certain to be announced Tuesday.

Many economists predict the Fed will cut its rate in half -- to just 0.50 percent. A few think the Fed could opt for an even more forceful action -- lowering rates by a whopping three-quarters percentage point or more. If that larger cut occurs, it would be the lowest on records that track the monthly average of the targeted funds rate going back to 1954.

Even an aggressive rate reduction won't turn the economy around, analysts said.

"It is not so much going to give the economy a big push forward. It's more a case of trying to help the economy from being pushed further backward by all these negative events," said Stuart Hoffman, chief economist at PNC Financial Services Group.

However deeply the Fed decides to cut rates, the prime rate -- now at 4 percent -- for many consumer and small-business loans would drop by a corresponding amount. The prime lending rate is used to peg rates on home equity loans, certain credit cards and other consumer loans. Cheaper rates could give pinched borrowers a dose of relief.

The goal of lower borrowing costs is to entice people and businesses to spend more, which would revive the flat-lined economy. So far, though, the Fed's aggressive rate reductions have failed to lift the country out of a recession that started last December.

Clobbered by the financial crisis, worried banks have hoarded their cash and been extremely reluctant to lend money to customers. Fearful consumers, watching jobs vanish and their investments tank, have sharply cut back their spending, including big-ticket purchases like homes and cars that typically involve financing.

The negative forces have fed off each other, creating a vicious cycle that Bernanke and Treasury Secretary Henry Paulson have been desperately trying to break.

To unlock lending and get financial markets to operate more normally, the U.S. has resorted to a string of radical actions, including a $700 billion financial bailout where the government is making cash injections in banks in return for partial ownership stakes.

In terms of rate cuts, the Fed is getting ever closer to running out of ammunition.

It can lower the funds rate only so far -- to zero. Even if that were to happen -- a point of debate among economists -- the prime rate would fall to 3 percent but no lower.

Against that backdrop, Bernanke says the central bank is exploring other ways to stimulate the economy.

The Fed could buy longer-term Treasury or agency securities on the open market in substantial quantities, Bernanke says. This might lower rates on these securities and help spur buying appetites.

Another option the Fed has mulled: issuing its own debt, which would give the central bank cash and more flexibility to battle the financial crisis. To do that, however, the Fed would need new powers from Congress.

"The Fed wants to show that it has tools and options and is not out of tricks because interest rates are very low," said Michael Feroli, economist at JPMorgan Economics. "The problems holding back the economy are fairly long lived in nature."

To combat the financial crisis, the Fed already has created first-of-its-kind programs, such as getting cash directly to companies by buying up mounds of "commercial paper," the short-term debt firms use to pay everyday expenses such as payroll and supplies.

It also recently launched massive programs to boost the availability of consumer credit, including that for cars, student loans, homes and credit cards. The Fed also is making loans to banks, is providing a financial backstop to the mutual fund industry, and has injected billions of dollars in financial markets here and abroad.

The Fed could opt to expand programs by enlarging loans it's now making, providing loans to other types of companies, or buying more and different types of debt. The Fed's balance sheet has ballooned to $2.2 trillion, from close to $900 billion in September, reflecting some of those other activities to get credit flowing again.

Even with all the bold moves, the economy continues to sink deeper into despair.

Skittish employers axed 533,000 jobs in November alone. That drove the unemployment rate up to 6.7 percent, a 15-year high.

Since the start of the recession, the economy has shed nearly 2 million jobs. Analysts predict another 3 million more will be lost between now and the spring of 2010.

Last week alone, Bank of America Corp., tool maker Stanley Works and Sara Lee Corp., known for food brands such as Jimmy Dean and Hillshire Farm, announced job cuts.

General Motors Corp., Chrysler LLC and Ford Motor Co., meanwhile, are fighting for their survival. GM and Chrysler have said they're in danger of running out of money within weeks. The White House is exploring new ways to help Detroit after rescue efforts collapsed in Congress.

With the employment market eroding and consumers retrenching, the economy could stagger backward at a shocking 6 percent rate in the current October-December quarter, analysts predict. It shrank at a 0.5 percent pace in the third quarter.

President-elect Barack Obama is advocating an economic recovery plan that includes spending on big public works projects to bolster jobs. His plan also includes tax cuts to spur consumers to spend more and businesses to step up investment and hiring.

Americans are sorely feeling the toll of the housing, credit and financial crises.

Households' net worth fell 4.7 percent in the third quarter to $56.5 trillion as people watched the value of their homes and investments tank. It marked the fourth straight quarterly decline, the Fed said.

'Business' 카테고리의 다른 글

| Report: Saudi's Prince Alwaleed lost $4B this year (0) | 2008.12.15 |

|---|---|

| Palm Needs One Good Phone (0) | 2008.12.15 |

| Many small banks waiting to access gov't funds (0) | 2008.12.15 |

| Discounts drive shoppers to stores this weekend (0) | 2008.12.15 |

| Wall Street looks to Fed, auto bailout this week (0) | 2008.12.15 |